So you’re looking around at college savings options and come across 529 Plans. Most of it sounds great. Flexibility, possible tax deductions, minimal impact on financial aid, tax free gains. But when you dig deeper, you discover that your contributions simply aren’t placed into a savings account, but are actually invested in things like stocks and mutual funds. Like most parents, you immediately go into worst-case scenario mode. ‘What if something like 2008 happens right before my kid goes off to college and half my account disappears?’ Well take a deep breath, because age-based portfolios are here to remove some of the worry. They provide investors with benefits that go beyond the numbers. Their structure adds a level of protection and sophistication that other investments may be missing.

Built-in Protection

These portfolios provide some peace of mind by having a built-in protective feature. Unlike static (unchanging) portfolios, which may be highly concentrated in equities, age-based portfolios allow you diversification based on your investment horizon. As the beneficiary ages and gets closer to college, the portfolio automatically reduces investments in higher risk, equity-based investments, and shifts the funds into more conservative ones. These changes happen in age bands depending on the age of the beneficiary. For instance an age band of 6-8 will have a riskier asset allocation than that of a 16-18 band.

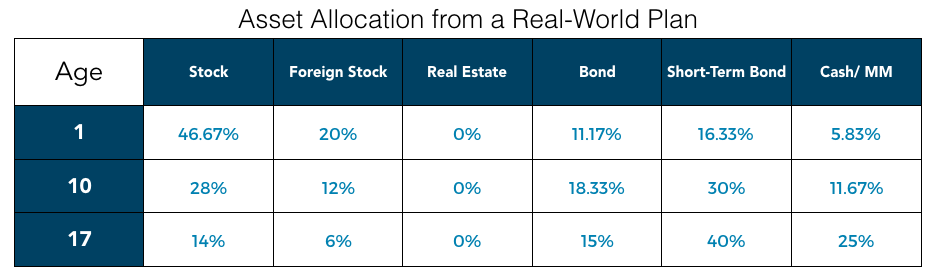

In this real world example, we can see how riskier equity investments (stocks and real estate) automatically decrease as the beneficiary approaches 18. Being in portfolio weighted towards fixed-income investments helps protect you from losses at a pivotal time.

In this real world example, we can see how riskier equity investments (stocks and real estate) automatically decrease as the beneficiary approaches 18. Being in portfolio weighted towards fixed-income investments helps protect you from losses at a pivotal time.

How They Work

When the beneficiary is younger, age-based portfolios are weighted toward higher return (and higher risk) investments, which provide more growth potential. An older beneficiary has limited time until the start of college, so a poorly timed market downturn could have a significant impact on your college savings goal. Much like retirement, college should be a well thought out plan and if that plan falls apart at the wrong time, the results can be ruinous. A younger beneficiary has more years of earnings potential to make up for lost gains. It is more important to be secure and well guarded when the time for college nears.

Get our FREE White Paper on Employer-Sponsored 529 plans

Sign up for our newsletter to get our Free White Paper on Employer-Sponsored 529 plans and receive the latest updates from our team.

You have Successfully Subscribed!

Download Link: http://bit.ly/1X1atHF

But Do Your Homework

Not all these age-based investments are built alike, however. Some reallocate themselves more often than others; some stay more aggressive for longer; some stay more conservative throughout the investment. Rhode Island’s CollegeBoundfund, for example, has 218 age-based portfolios[1]! A riskier investor might still want some equity exposure when their child is 18. A more conservative one might want to be completely in fixed-income assets by the time their child is 16. So how do you decide which allocation is best for you?

When left to decide for themselves, people will generally act like they are more aggressive than they really are. After all, this is just the step before you’re money is actually invested and more risk means more returns, right? At Gradvisor, we mathematically compute your risk tolerance through a series of questions and place you into a proper portfolio that fits the type of investor you are. You can thank us when the market takes a dip and you don’t feel like pulling all of your hair out.

There will always be the more hands-on types of investors who prefer to reallocate static portfolios themselves. But not everyone has the know-how or the time for that. 529 Plans put professional money managers at your fingertips, so if you want a plan that does all the hard work for you, choose an age-based portfolio. It will provide some peace of mind and allow you to concentrate on the fun stuff like filling out FAFSA applications.

[1] Investmentnews.com, 529 college savings plans, http://www.investmentnews.com/article/20131222/CHART02/131219878/529-college-savings-plans