At Savingforcollege.com, we believe one of the most effective ways to save for college is by using a 529 plan. With a 529 plan, your earnings grow tax-free and withdrawals used toward qualified higher education expenses (QHEE) will avoid federal, and, in some cases, state taxes. However, non-qualified distributions will be subject to income taxes as well as a 10% penalty tax. To maximize your savings potential, it’s a good idea to make sure you understand exactly how much your costs will be before you withdraw the funds. Most colleges provide information on the costs related to a standard nine-month school year, but what happens if your child takes summer classes?

Determine the Amount of Your QHEEs

In order for your withdrawals to remain tax-free your distributions cannot be in excess of your total QHEEs. QHEEs include tuition and other fees, course requirements such as books, calculators and software and services for special-needs students. Room and Board (on and off campus) also falls under the blanket of QHEEs.

If you, or the beneficiary, are claiming any other credits such as the American Opportunity, Hope or Lifetime Learning credit, you must reduce your QHEE accordingly to come to your adjusted qualified higher education expenses (AQHEE). Withdrawal amounts taken above your AQHEE are considered non-qualified distributions. In most cases, these distributions will be subject to federal income tax as well as a 10% penalty.

Get our FREE White Paper on Employer-Sponsored 529 plans

Sign up for our newsletter to get our Free White Paper on Employer-Sponsored 529 plans and receive the latest updates from our team.

You have Successfully Subscribed!

Download Link: http://bit.ly/1X1atHF

Calculate the Cost of Summer Attendance

You can usually find figures pertaining to cost of attendance, such as tuition, room and board, etc. on the college’s website. For example, the University of Florida (UF) lists a tuition/fees cost of $6,630 for resident undergrads (non-residents should add $22,278 to this figure) and a housing cost of $5,340[1]. However, these figures are for the standard 9-month school year, and do not include summer.

While some schools, including the University of Florida, will also provide the cost of attendance figures for summer classes, this is not always the case. If your school does not, there are a few calculations than can be used to prorate costs and assure you do not take too big of a 529 distribution and subject yourself to federal taxes and the 10% penalty.

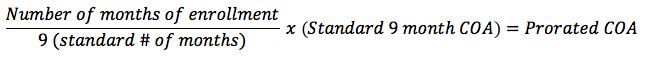

Prorated Cost of Attendance (COA)

OR

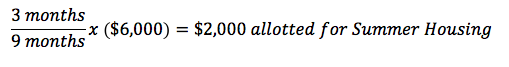

For example: If the beneficiary’s school allotted $6,000 for housing in the normal 9-month cost of attendance and your child was attending summer class for 3 months:

OR

This means you can substantiate withdrawing up to $2,000 from your 529 as a QHEE, which will be a tax-free distribution. These formulas can be used for all categories of QHEE that the school provides. If the school does not provide a normal 9-month figure, it is best to contact them.

Beware of Summer Withdrawal Traps

While certain items like tuition and fees will always be allowed, some costs require more research. Room and board is technically a required expense, but distributions will only be qualified if the beneficiary is enrolled at least half-time. For most universities, this means the student must be taking at least six credit hours per term. For requisite half-time graduate school hours, it is best to contact the university.

For example, your child may wish to spend the summer months living on campus. Before you withdraw from your 529 account to pay the rent, make sure they are taking the minimum required credit hours. If not, you will be subject to federal tax as well as the 10% penalty on that portion of the distribution.

While taking summer classes can be a great way for your child to get ahead, keep in mind that courses are usually shorter, often only six to eight weeks long. This, along with the fact that there may be fewer classes available may make it difficult to squeeze in enough credit hours to be considered half-time.