Imagine one of your employees walks up to you and asks if your company offers any assistance in saving for college. What does this employee look like in your mind? Probably a little older, a little higher up in the chain of command with a nice salary, right?

And that’s a fair thought. We generally view those with lofty savings goals as these types of employees. But, there is a large segment of the workforce, actually the largest cohort of the workforce according to the Pew Research Center, who are the most ambitious savers when it comes to their children’s higher education.[1] And they might not be the ones you’d expect.

Millennials, those born between 1981-1997, have shown a true commitment to saving for college, with 71% having started to save, according to Fidelity’s 9th Annual College Savings Indicator.[2] This might seem counterintuitive as not a day goes by where there isn’t an article about millennials being saddled by student debt.

Get our FREE White Paper on Employer-Sponsored 529 plans

Sign up for our newsletter to get our Free White Paper on Employer-Sponsored 529 plans and receive the latest updates from our team.

You have Successfully Subscribed!

Download Link: http://bit.ly/1X1atHF

However, the Fidelity survey indicates that 56% of these millennials saving for college are still paying back their own student loans, indicating those who have felt the burden loans have on their lives want to shield their children from having to deal with it in the future.[3] In fact, 87% of millennial parents agreed that their own student debt is motivating them to save for their children’s college education.[4]

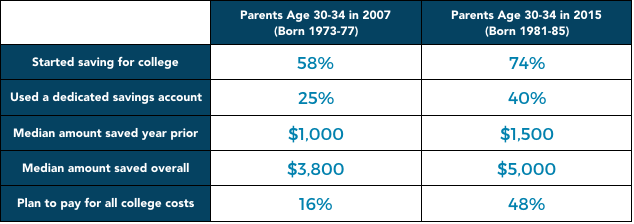

So just how ambitious are these young parents? Nearly HALF of them (46%) plan to pay their kids’ FULL college bill.[5] Not only that, of those parents currently paying back their own student loans, 91% of them plan to re-allocate those dollars toward their children’s funds as soon as they’re paid off.[6] This type of commitment is not only unheard of, but also starkly different than it was even just a few years ago.

Data from: Fidelity’s 9th Annual College Savings Indicator

It took just 8 years to see this radical change in savings behavior. And with the cost of college continuing to increase, there’s no reason to think this trend will not continue.

So, if you’re involved in selecting benefits for your organization, don’t think that college savings would only apply to a small segment of your employees. After all saving for college is the #1 concern amongst all parents with 73% say they are ‘worried’ or ‘very worried’ about it.[7] And we all know grandparents love saving for their grandchildren. It’s a benefit that can be used by just about anyone.

[1] Pew Research Center, Millennials surpass Gen Xers as the largest generation in U.S. labor force, http://www.pewresearch.org/fact-tank/2015/05/11/millennials-surpass-gen-xers-as-the-largest-generation-in-u-s-labor-force/

[2] Fidelity, 9th Annual College Savings Indicator, https://www.fidelity.com/binpublic/060_www_fidelity_com/documents/CSI-Exec-Summary-NATL.pdf

[3] Id.

[4] Id.

[5] Id.

[6] Id.

[7] GALLUP, U.S. Parents’ College Funding Worries Are Top Money Concern, http://www.gallup.com/poll/182537/parents-college-funding-worries-top-money-concern.aspx