Saving for college is now the #1 household concern among parents, according to GALLUP.[1] These parents, many of them employees of corporations, are used to leaning on their employer for help in every aspect of their lives. Retirement, healthcare, dental, vision, discount programs and yes, even pet insurance. So where is all the help for parental employees when it comes to their #1 concern? Only 7.6% of employers currently offer some sort of college savings program, and with good reason. As you’ll see, the landscape is incredibly complex.

The lay of the land

529 college savings plans are tax-advantaged investment vehicles designed specifically to pay for college costs. They are operated by the states and state agencies, but investors are not limited to using their home state’s plan. Every state (except Wyoming) currently operates a 529 plan. Each one has its own pros and cons, investment options, historical performance and potential tax benefits. Investors are able to open up any one of them (except for a few cases in prepaid plans in which there may be residency restrictions).

This open access creates a complex landscape not only for savers, but for employers considering rolling out a plan to their employees as well. Employers are left with the difficult task of selecting one plan to suit their entire company’s needs. This problem becomes increasingly complex when employees live in multiple states, due to various tax implications.

34 states, including the District of Columbia, offer a tax incentive for contributions to 529 plans. However, in 28 of those states, the benefit is only offered to residents who invest in their home state’s plan. This can create a sticky situation for larger companies with locations nationwide, as they would need to partner with multiple plans to ensure their employees don’t forfeit these tax benefits.

Not doing your homework can cost you

For example, let’s say you are an employer based in State A and you have employees in states B, C, and D. States A and B do not afford residents a tax benefit, but states C and D do. That means, no matter which 529 plan you partner with, some employees will be foregoing a tax benefit. This could expose a well-intentioned employer to possible litigation.

In fact, in 2005, the National Association of Securities Dealers (NASD) fined Ameriprise Financial $500,000 for failing to inform clients about the potential tax benefits they were giving up by purchasing an out-of-state 529 plan. The firm was also ordered to pay approximately $750,000 to compensate over 500 accounts for the lost tax benefits.[2]

Employers also need to keep a close eye on plan costs. As stated earlier, each plan will have a different array of fees, and over time, fees can substantially erode earnings. Therefore, blindly partnering with a plan with high fees can cause employers to lose out on potential profits, and limit the amount their employees are able to save for college.

Employers should be especially cautious of this as the Supreme Court recently ruled that employers have a duty to monitor 401(k) investments for unnecessarily high fees. As employer-sponsored 529 plans gain popularity, there is no reason to think they won’t be held to the same standard.[3]

A real-world example

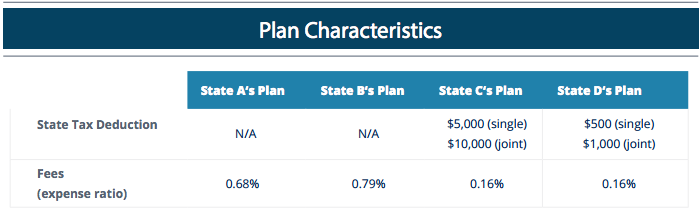

Let’s look at an example. Below are four real-world 529 plans from four different states.

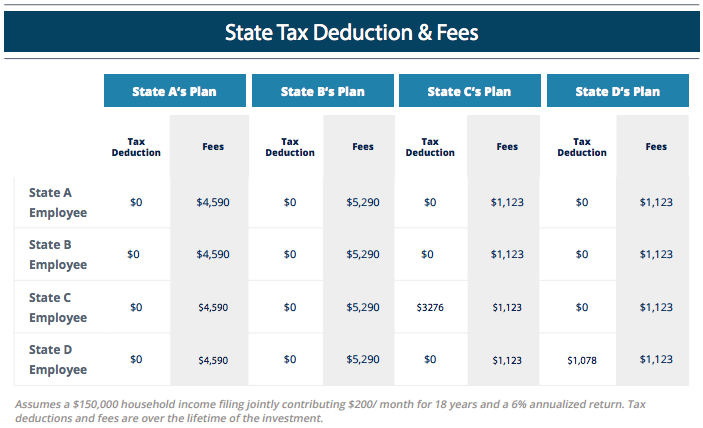

Part of the difficulty of an employer offering a single plan is harmonizing tax and geographic information across their employee base. As you can see below, taxes and fees can vary widely depending on which plan the employee invests in and which state they currently reside.

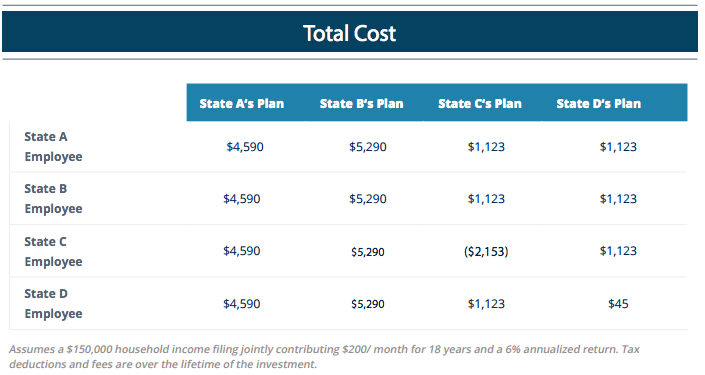

After offsetting fees with any potential tax deduction the employee may receive, it becomes very clear why a company would have a hard time selecting a single 529 plan to offer to their employees, especially one with employees in multiple states.

Get our FREE White Paper on Employer-Sponsored 529 plans

Sign up for our newsletter to get our Free White Paper on Employer-Sponsored 529 plans and receive the latest updates from our team.

You have Successfully Subscribed!

Download Link: http://bit.ly/1X1atHF

In the table below we see that employees A and B would be wise to invest a plan from States C or D, but employees C and D would be better off using their own state’s plans. Yet employers who sponsor 529 plans typically only offer employees one option.

This is why we built the Gradvisor platform to offer at least one plan from every state (except for WY, which doesn’t operate a 529 plan) to give employees access to any potential state tax benefits, as well as an opportunity to find the investment at the lowest cost. This solution not only maximizes employees’ college savings, but also protects employers from legal disputes down the road. We hope that this access combined with technology and innovation will help more employers offer college savings plan to their employees.

The student debt problem is getting out of hand in this country. We can help quell this impending crisis by helping more parents save. Employers, it’s time to help.

[1] GALLUP, U.S. Parents’ College Funding Worries are Top Money Concern, http://www.gallup.com/poll/182537/parents-college-funding-worries-top-money-concern.aspx

[2] FINRA, NASD Fines Ameriprise Financial Services, Inc. $500,000 for Supervisory Violations in 529 College Savings Plan Sales, https://www.finra.org/newsroom/2005/nasd-fines-ameriprise-financial-services-inc-500000-supervisory-violations-529-college

[3] LA Times, Employers must monitor 401(k) fees, Supreme Court rules, http://www.latimes.com/business/la-fi-court-edison-401k-fees-20150519-story.html