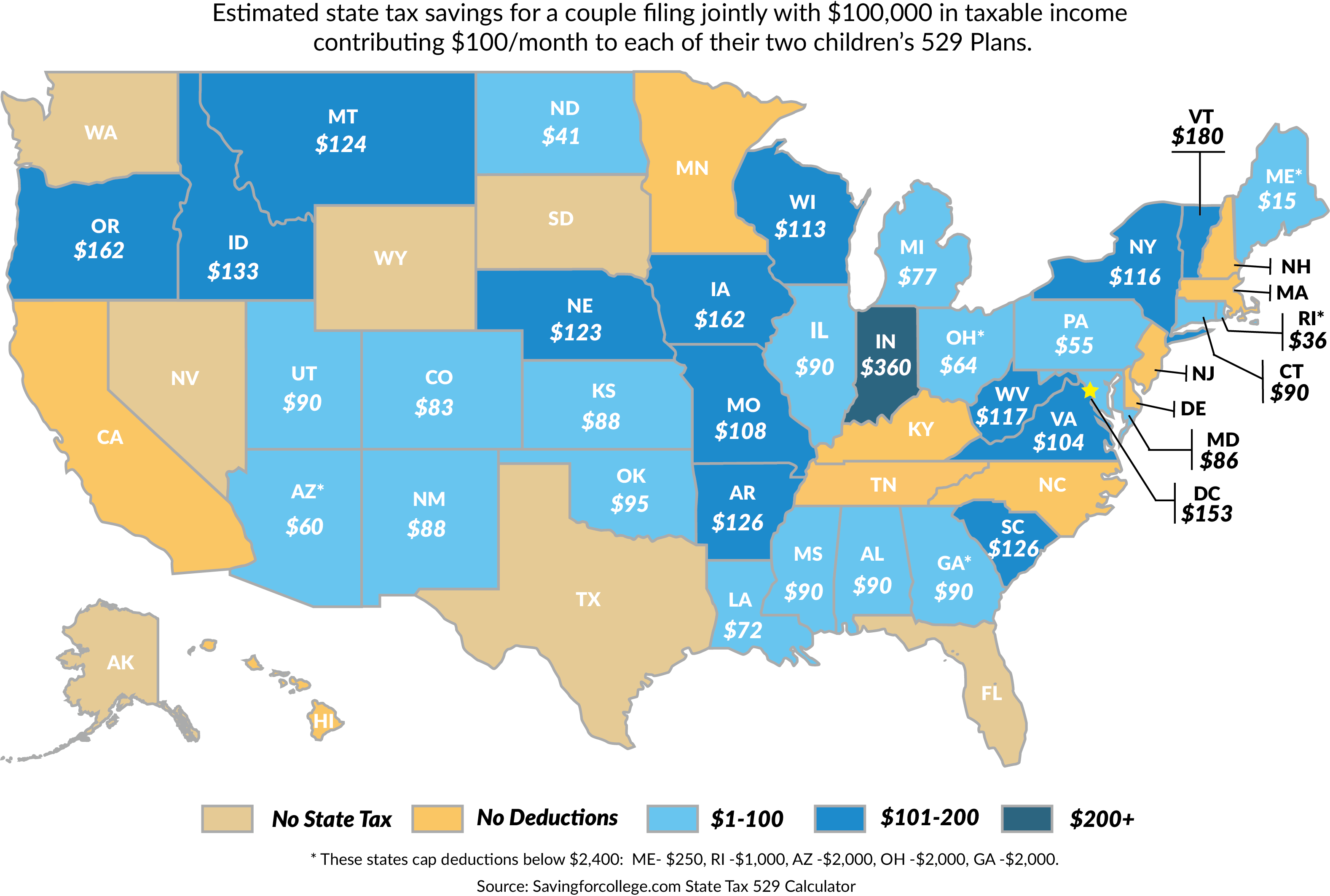

In addition to federal tax benefits, many states offer full or partial state tax deductions for contributions to a 529 plan. So far 34 states, including the District of Columbia have such incentives available.

Six of these states offer taxpayers a deduction for contributions to any state’s 529 plan: Arizona, Kansas, Maine, Missouri, Montana and Pennsylvania.

Eight states currently have a state income tax, but do not offer a deduction for contributions: California, Delaware, Hawaii, Kentucky, Massachusetts, Minnesota, New Jersey, and North Carolina.

While tax deductions can make opening your own state’s plan seem particularly attractive, they should not be your only consideration when choosing a 529 plan. Attributes such as fees and performance must always be taken into account. In some cases, better investment performance of another state’s plan (where earnings are compounded) can outweigh the benefits of a tax deduction. To get a better idea of how much your state tax benefit is worth, check the map below: